$PYPL PayPal - Having a Midlife Crisis?

When valuing companies the size of PayPal, I find it important to gauge where the company is within the corporate lifecycle:

(Slide from Aswath Damodaran’s course on Valuation)

The question we need to ask here is: “Where do PayPal’s policies put them on this chart?”

To which my answer would be “The Midlife Crisis” - Mainly motivated by PayPal’s cash buildup, which allows them to execute approximately $5 Billion in share buybacks per year.

In fact, I view the aggressive decline in share price over the last 18 months to be largely driven by investors realizing they have reached this stage.

Nonetheless, we must remember that all of the current behemoths of the NYSE ($AAPL, $MSFT, $AMZN, $GOOG, etc) have also gone through this maturing process…

So what kept those companies attractive to investors while other mature companies faded into the abyss?

Well, the answer may be complicated, but I largely attribute their maintained relevance to their huge push to innovate, despite their massive corporate size.

Amazon continued to push toward AWS, now pushing toward grocery and other verticals, Microsoft pushed hard to partner with OpenAI, Apple has at least attempted to create new tech like the vision pro headset, and Google has time after time produced cutting-edge research in AI and computing. So, where does PayPal stand?

Paypal recently picked up a new CEO with the intent to drive innovation within the company:

Alex Chriss - Chief Executive Officer Tenure: Since 9/27/2023

Track Record:

- Executive Vice President and General Manager of Intuit Inc.'s Small Business and Self-Employed Group since January 2019

- Led global teams for QuickBooks and Mailchimp - Chief Product Officer for Intuit's Small Business Group (2017-2019)

- Joined Intuit in July 2004, ascending through various leadership roles

Vision:

- Providing innovative solutions for small businesses and self-employed individuals under the PayPal umbrella

Previous Initiatives:

- Developed Intuit's Partner & Developer Platform

- Played a pivotal role in the acquisition of MailChimp

What he brings to the table:

- Deep technology and product leadership experience, along with a proven track record of substantial customer and revenue growth

- Young and fresh perspective on innovation and growth for the already behemoth sized company PayPal

So, assuming Alex Chriss can bring

growth and innovation to PayPal…

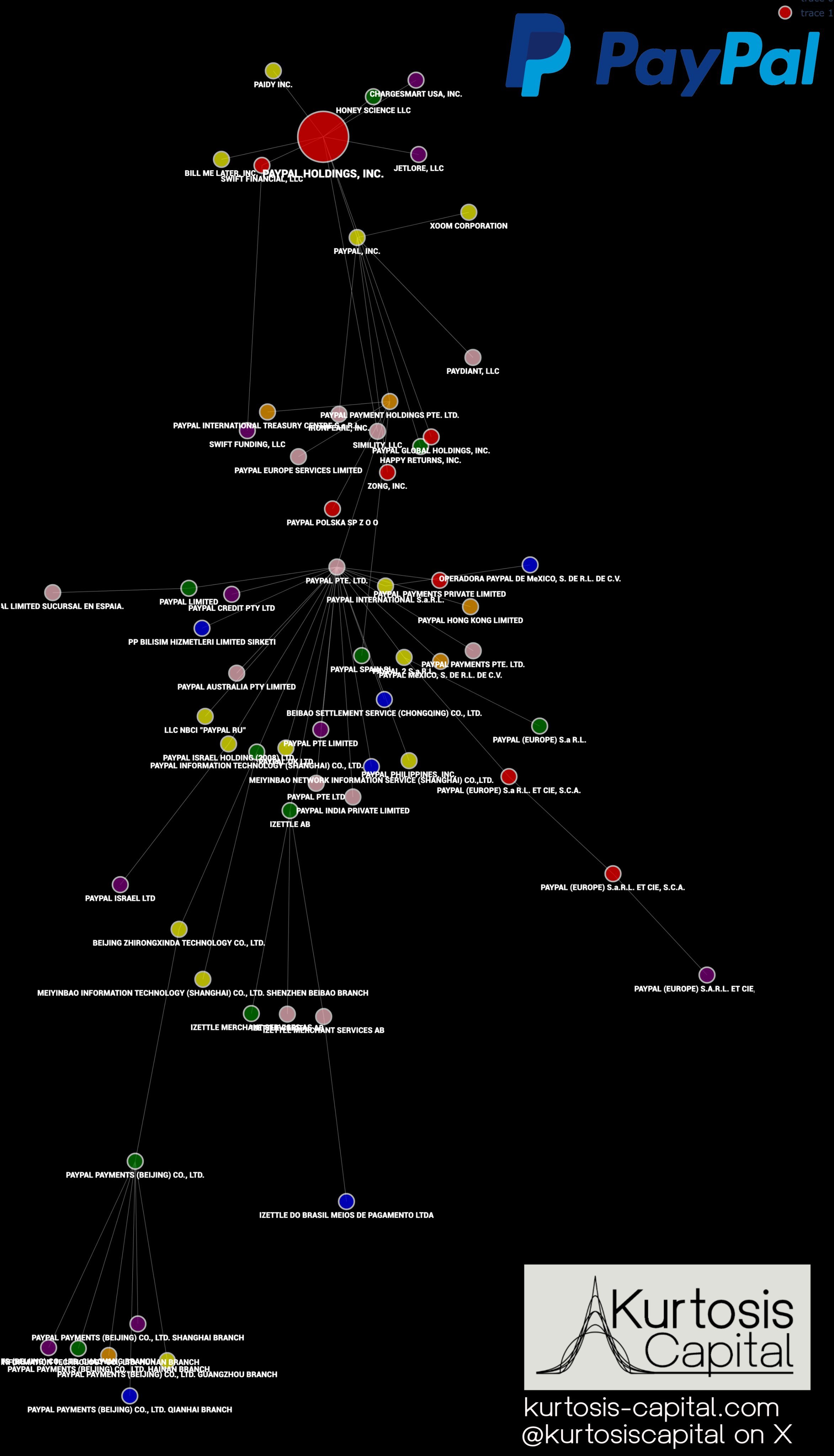

how does this provide value to a corporate network as vast as this?

Well, in order to model the value of the company, one would typically rely on the standard Discounted Cash Flow (DCF):

Most are familiar with traditional Discounted Cash Flow (DCF) valuation methods. The main issue with this approach, however, is that one incorrect assumption in the model can lead to valuations that don’t accurately reflect the company’s realized performance. (even the ones I talk about below are always wrong - the goal is to minimize how wrong)

One way to navigate this is by assigning uncertainty to each of the assumptions and using Monte Carlo (repeated iteration) methods to produce a range of valuations rather than a single valuation.

We analyze PayPal ($PYPL) by using this approach and use known statistical distributions to quantify the uncertainty of each of the assumptions:

(Image from Farbod Baharkoush)

The Monte Carlo method is a statistical technique that allows analysts to incorporate the variability and risk of different financial metrics into their models. By running thousands of simulations, this method produces a distribution of possible outcomes, which can give us a probabilistic understanding of the valuation of a stock like $PYPL. We're not content with a single-point estimate; instead, we're considering a range of possible values for each input, reflecting the real-world uncertainty faced by the company.

For uncertain metrics, we assign uncertainty according to a chosen distribution. Typically, these can be chosen in an algorithmic fashion:

(Image from LearnbyInsight)

Here, we quantify the uncertainty of each of the critical items to PayPal’s valuation by examining the Balance Sheet and Financial Statements:

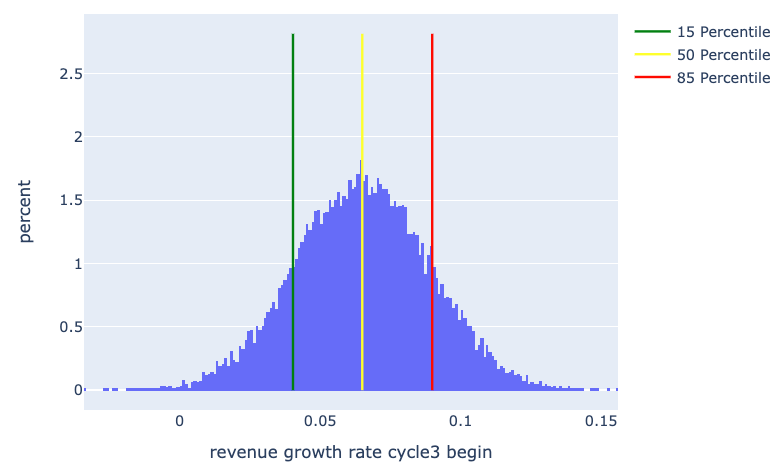

And we assign uncertainty to each of the fundamental component of the DCF, and bearishly assume PayPal will only grow at 8.5% this year and decrease toward the perpetual growth rate of 3.5%, and summarize the metrics in the following distributions:

We see that under this assumption, PayPal is currently fairly valued by the market:

So the pivotal question is: Can Alex Chriss and the team at PayPal reignite some growth for the company?

Let's perform a conservative simulation under this assumption, allowing PayPal to grow at approximately 10% in the near term:

Under this assumption, we see slight undervaluation in $PYPL, realizing an expectation value in Market Cap today of approximately $80B.

Moral of the story? By investing in PayPal today, we are putting explicit faith in the executive team to grow the company at least 10% YoY in the near-term, and the question to ask yourself is: “Can they meet/beat this expectation?”

Additionally, we note that while the DCF model accounts for all future cash flows, when valuing the per-share value, we should also account for buybacks.

This involves converting the already accounted for cash flow into direct share reduction, so that it isn’t being double-counted. Notably, PayPal has committed to ~$5B in share buybacks for the current year, so it is reasonable to model the per-share price in a post reduction fashion:

(current shares outstanding) - (2024 Buybacks) = per-share value

We assume a conservative average repurchase price of $70/share during 2024 and find:

(1,094,000,000) - (71,428,571) = 1,022,571,429 shares outstanding Jan 1, 2025 (Ignoring dilution for now)

This yields a minor change in the current value/share of future cash flows.

Assuming 8.5% growth we see present value expectation of around $72.00/share at the end of this year:

And assuming 10% near-term growth we see a present value expectation of around $78.00/share

Furthermore, if we assume we intend to hold the investment for three years, and that the company will commit ~$5B in share buybacks per year, we see a fair value today of around $88.00/share

Essentially, by investing in PayPal we are making two assumptions:

1. The new executive team can drive at least minor increases in annual growth

2. The company will continue to repurchase shares at around $5B per year

Disclaimers:

- I own $PYPL stock

- This analysis and article are for informational purposes only and should not be considered financial advice. Investment decisions should be based on individual risk tolerance and financial goals.

- We do not make personal investment recommendations and only provide research insight.

At Kurtosis, we strive to give retail investors access to quality insights and analyses - please consider subscribing to our newsletter and following us on X: https://twitter.com/kurtosiscapital