$SOFI SoFi Technologies, Inc. - Disrupting Modern Banking

SoFi originally aimed solely to provide more affordable options for education funding, a mission rooted in its original name, Social Finance Inc.

The company's pilot program at Stanford, where 40 alumni loaned about $2 million to approximately 100 students, set the stage for a revolutionary approach to lending.

By September 2013, SoFi had expanded its reach, funding $200 million in loans to 2,500 borrowers across 100 eligible schools.

This model quickly expanded further, with SoFi introducing mortgages in 2014 and personal loans in 2015, the same year it became the first U.S. fintech to secure a $1 billion funding round. In 2019, we saw SoFi broaden its offerings with SoFi Money® and SoFi Invest®.

A Story of Innovation and Growth

2012: Raised $77.2 million, signaling strong investor confidence.

2013: Secured $500 million in debt and equity for student loans.

2014-2018: Expanded into mortgages, personal loans, and overcame FTC charges.

2019-2023: Public Listing, Several acquisitions, Reached over $10B in total deposits Named as one of the World's Most Innovative Companies.

2024: 18.6 billion total deposits reported for year-end 2023. Issues $750 million of convertible senior notes due in 2029 to buy down high interest rate loans and grow the company.

What is SoFi offering today?

Banking, of course: Following its bank charter approval in 2022, SoFi launched high-yield checking and savings accounts, marking its entry into traditional banking and flagging itself as a disruptor and threat to the long-standing banking norms.

“We’re really stealing share from the big banks, and so we’ve been able to add more than $2 billion of deposits in each quarter since getting our bank license... we remain confident that we can add $2 billion-plus each quarter, and we’re on track to do that” - CEO Anthony Noto

Lending Services: Including student, personal, and home loans, SoFi has become a leading provider of loans in many categories.

SoFi Invest: Launched in 2018, this platform democratized investment, offering commission and fee-free trades of stocks and ETFs. They later added IPO access for retail investors. They are pivoting to also be a disruptor of modern retail investing.

Insurance Products: Through partnerships with companies like Lemonade, Inc., SoFi has expanded into offering insurance products.

Open-Network ATMs: The platform's digital-first approach, combined with access to over 55,000 fee-free ATMs via the Allpoint network provides users with an alternative to closed-network, big banks with limited ATM interoperability.

Interest Payments for Customers: SoFi distinguishes itself by offering competitive interest rates - up to seven times the national average, alongside bonuses, no monthly maintenance fees, and a suite of other financial benefits. Such features are not only attractive but significantly enhance the banking experience for modern consumers. Its key to pulling market share from the big dogs.

Record Revenue and Profitability:

SoFi achieved a pivotal milestone by posting positive quarterly net income for the first time since going public, a significant achievement highlighted by a 35% revenue increase to $615 million in the quarter.

This growth is fueled by SoFi's diversified business model, spanning lending, technology platform services, and financial services - all of which reported record revenue.

SoFi's bank charter allows for deposit-taking and lowers lending costs, contributing to a 43% year-over-year increase in net interest income.

Recent offer of up to $2 million in FDIC insurance for checking and savings members. This may pull large clients away from other banks en masse.

By the numbers:

- In Q4 2023 net income of $48 million.

- Net revenue surged by 35% to $615 million, with adjusted net revenue reaching $594 million.

- 11th consecutive quarter where the firm reported record adjusted net revenue.

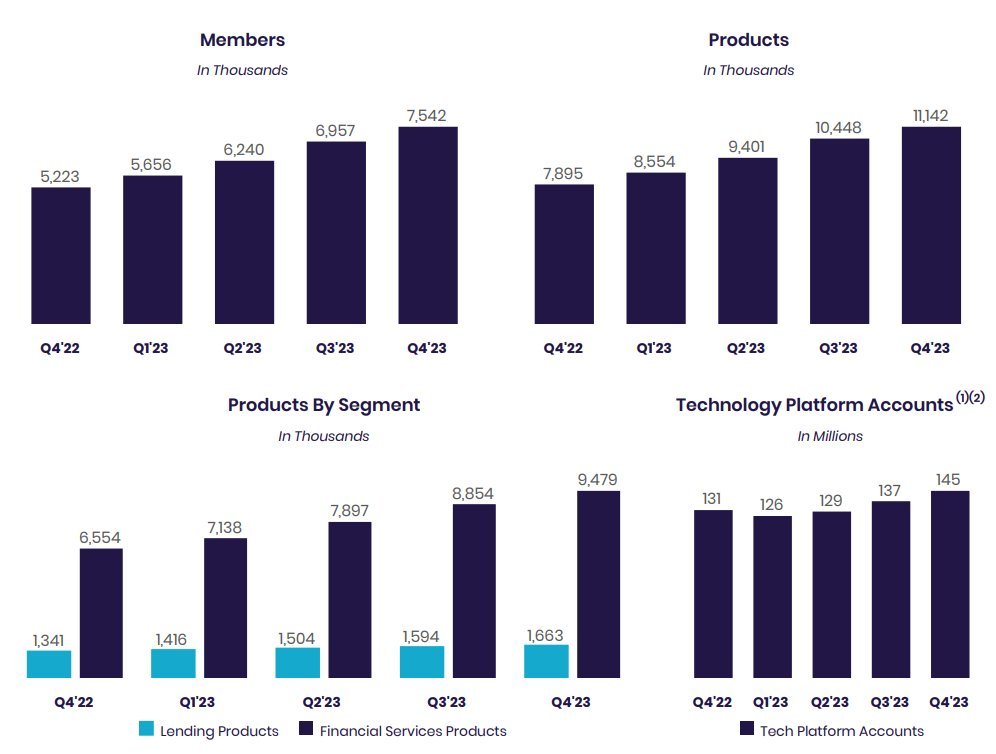

- Substantial growth in its member base, adding 585,000 new members or customers, boosting its total to 7.5 million. (8% increase from the previous quarter and a 44% year-over-year growth)

- Expanded its product offerings, adding 695,000 new products in the quarter, bringing the total to 11.1 million (41% increase year over year) SoFi's lending business, its largest source of revenue, saw loan originations increase by 45% in the quarter. This included a 31% jump in personal loans to $3.2 billion, a 95% rise in student loans to $790 million, largely due to the lifting of the student loan repayment moratorium, and a 193% increase in home loans to $309 million.

Guidance:

For Q1 2024, the company targets net income in the range of $10 million to $20 million, up from a net loss of $34 million in Q1 2023. EBITDA is much higher.

Projecting $550 million to $560 million of adjusted net revenue for the first quarter of 2024, up from $460 million in the same quarter of the previous year, and adjusted EBITDA of $110 to $120 million, up from $76 million in Q1 2023.

For the full year of 2024, the company anticipates more growth from its Tech Platform and Financial Services segments, with each expected to grow its revenue by 50%.

Expects lending revenue to be at 92% to 95% of 2023 levels, with expenses roughly flat compared to 2023.

Ultimately, SoFi anticipates full-year net income in the range of $95 million to $105 million, or 7 cents to 8 cents per share, and targets adding 2.3 million new members, a 30% growth.

Longer-term, SoFi management is aiming for 20% to 25% compound annual revenue growth through 2026. We think this might be a low-ball. We see that these projections would drive SoFi’s earnings to between 55 cents and 80 cents per share in 2026. Accompanied by 20% to 25% EPS growth.

We initiated purchases of $SOFI shares recently, around $7.50/share after the news of their secondary notes offer impacted the price negatively. We hope to see 30%+ upside in this position in 2024.

Disclaimers:

- I own $SOFI stock!

- This analysis and article are for informational purposes only and should not be considered financial advice. Investment decisions should be based on individual risk tolerance and financial goals.

- We do not make personal investment recommendations and only provide research insight.

At Kurtosis, we strive to give retail investors access to the type of analysis performed by quants and analysts on Wall St. every day.